For decades, the UK North Sea has been a testbed for pioneering technologies used to produce billions of barrels of North Sea Oil & Gas, underpinning the UK’s energy security, and now with the energy transition we are actively engaged in managing the transition to renewable energy and carbon reduction technologies to reduce the impact on the earth's climate.

In support of our Strategy, the NSTA has a role in the development and deployment of technologies which support energy security and emissions reduction.

We gather information from Operators about the technologies they have already installed and their efforts to identify solutions which could enhance operations in future.

This information is collated and analysed to create insights for the benefit of the Operators and published in the NSTA’s annual Technology Insights report to raise awareness of technologies which are having a positive impact and to accelerate their deployment across the North Sea.

This consolidated view of technology deployment by Operators is an important indicator of the state of the industry to meet current needs and to highlight priority areas of focus to help prepare for the future.

- 50 UKCS Operators completed the annual Technology Survey and submitted Technology Plans by the end of February 2024.

- There was strong evidence of a continuing focus on technologies for the effective and cost-efficient development of remaining hydrocarbon resources, complemented by efforts to reduce emissions.

Notable examples:

Drilling and well construction

- Low-cost platform modular drilling rig systems

- Lightweight compact trees

- Thru-tubing isolation barrier valve

- Digital well planning using AI

- Combine wireline tool strings

- Tubing retrievable surface controlled subsurface safety valve

Facilities Design and Inspections

- High frequency vibration and axial data analysis

- Cost efficient pipelines and longer tie-backs

- Subsea gas compression and multiphase boosting

- Non-intrusive inspection technologies

- AI for risk-based inspection systems

- Controls and automation

Well intervention

- Wireless downhole surveillance technologies

- Disposable fibre-lines

- Retrofit DHSVs and ESPs

- Flexible zonal isolation solutions

- Real time slickline and coiled tubing solutions

- Water shut-off solutions

Emission reduction

- Flare gas recovery systems

- Vapour recovery systems

- Enhanced emissions monitoring – including fugitives and flare efficiency measurement

- Electrification

- Hybrid energy systems

Technology Survey & Plans

-

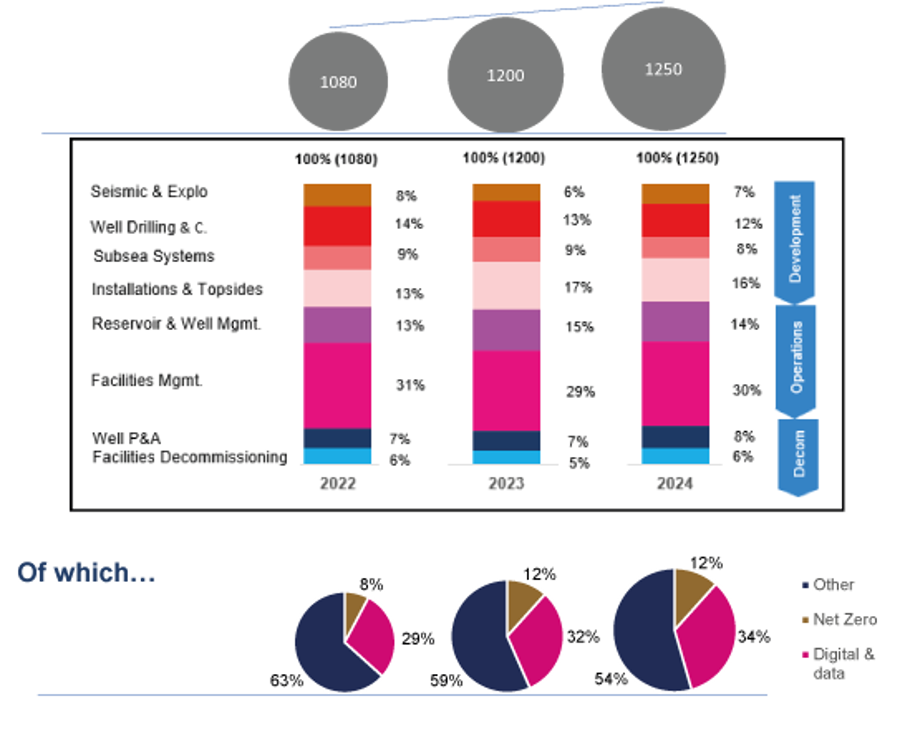

1,250 technologies referenced in 2024. This includes each case of the reported use of a specific technology by an operator. If an operator uses a technology on more than one asset it is only counted as a single use for this figure.

-

This net increase accounts for removal of successful technologies now considered mainstream and unsuccessful technologies after their screening and pilots

-

Nearly equal split between technologies for new asset developments and those for asset operations

-

Installation & Topsides remains steady because of recent focus on emission reduction

-

Digital and Net zero themes, which cut across all these domains, are expanding rapidly

Number of technologies reported (UKCS operators)

Image Description Number of technologies reported (UKCS operators)

Operators’ Technology Uptake & Sources

-

Focus on active technology management among UKCS Operators has increased steadily

-

22 Operators are reporting more than 10 distinct technologies this year - from a lower base of 18 operators in 2022

-

Over half of the technologies (60%) are sourced directly from vendors/suppliers and this trend continues to increase this year

-

However, in over 22% of the cases, Operators actively partner with selected suppliers to develop solutions in partnership, and/or form Joint Industry Projects

-

There is a visible contribution of the Net Zero Technology Centre (NZTC) in supporting and facilitating technology innovation (6% of overall technologies surveyed)

Number of technologies reported by Operator

Image description - Number of technologies reported by Operator

Technology sourcing

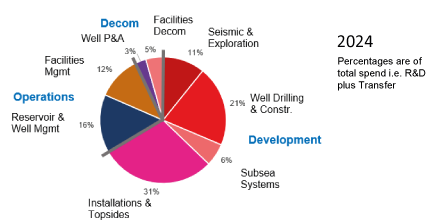

Operators’ Technology Spend

-

Operators make a sizeable contribution to technology research and development (R&D) for UKCS needs

-

In 2024, £78m of direct R&D spend is targeted, this is comparable to previous years, but less in real terms than a decade ago (Note: These are “money of the day” values (not factored for inflation).

-

Until 2025 the Technology Transfer spend (defined as the cost to deploy the technologies in the field) is higher than the direct R&D expenditure.

-

Development categories attract the largest proportion of Operators’ technology spend

Direct spend on technology

Download

Click to on the items to download.

Download

-

The Complete listing of all 1250 technologies reported XLSX - 2mb

-

The consolidated technology needs listing XLSX - 47kb

Click to on the items to download.