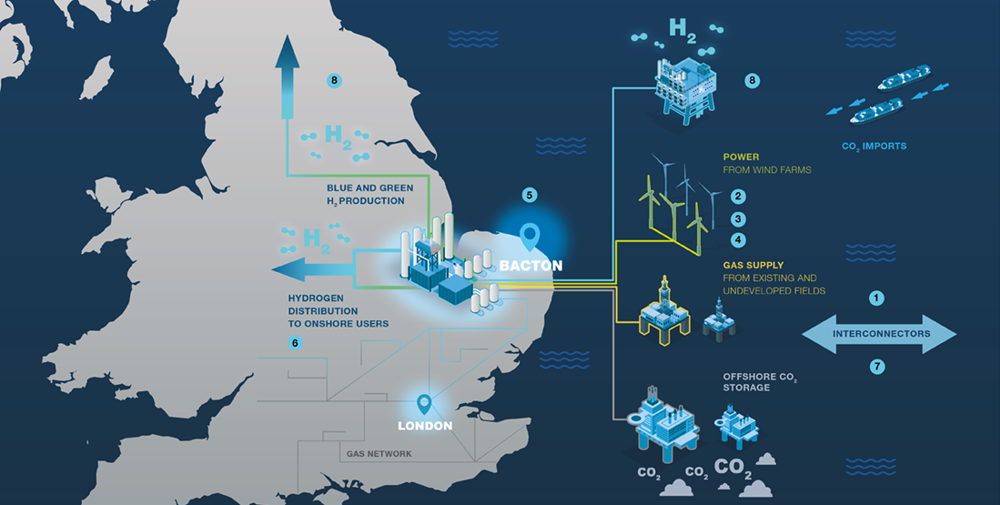

The NSTA recognises that Bacton has the potential to establish itself as a low carbon hydrogen hub.

This would ensure Bacton remains a key regional energy hub, leveraging existing infrastructure and resource in the region to ensure its low carbon future.

To further understand what a low carbon future for Bacton will look like, the NSTA established five Special Interest Groups (SIGs): Hydrogen Demand, Hydrogen Supply, Infrastructure, Regulatory and Supply Chain and Technology. Through a collaborative industry approach, they have been working to help demonstrate that a credible project exists and to catalyse the formation of a consortium that will develop and execute a Bacton Energy Plan.

Bacton Energy Hub Business Opportunity Report

The Bacton Energy Hub Business Opportunity Report summarises the key findings from the five SIGs and outlines the business opportunity that could exist for a consortium to take forward the Bacton Energy Hub vision.

Background to the Bacton Energy Hub Special Interest Groups (SIGs) and their reports

The purpose of the Hydrogen Demand SIG, led by Progressive Energy, was to:

- Quantify potential hydrogen demand by sector in the Bacton Catchment Area.

- Understand seasonal and diurnal variability in demand across sectors.

- Understand key sensitivities, drivers, and blockers to demand cases.

- Assess hydrogen storage requirements and identify storage scenarios.

- Inform hydrogen supply and infrastructure.

Downloads

Reports

- Bacton Energy Hub Hydrogen Demand – SIG report

- Bacton Energy Hub Hydrogen Storage – SIG supplementary report

Launch Presentation

Core Group members

- Jacobs

- National Grid

- Progressive Energy

- Summit

- Northbrook

The purpose of the Hydrogen Supply SIG, led by Summit Energy Evolution, was to:

- Identify constraints and blockers to using indigenous gas production for blue hydrogen production.

- Understand and overcome current technological constraints to meet domestic and potentially international low carbon hydrogen demand.

- Identify, investigate, and progress CCS opportunities in the SNS for the Hub.

- Determine development, operating and abandonment costs to make a project viable and investable.

Downloads

Reports

- Bacton Energy Hub Hydrogen Supply SIG – Summary Report

- Bacton Energy Hub LCOH Analysis

- Bacton Energy Hub LCOH Data

- Bacton Long Term Gas Lookahead

- Bacton Long Term Gas Lookahead Data

- Bacton SNS CCS Screening

- BEH Supply SIG - Desalination Summary Report

- Blue Hydrogen Technology Review

- Green Hydrogen Scoping Report

- Green Hydrogen Technology Review

- Project Development Phasing

- Power Supply Technical Note

Launch Presentations

Core Group members

- Fluor

- National Grid

- Neptune

- Summit

The purpose of the Infrastructure SIG, led by Xodus, was to:

-

- Engage industry and local stakeholders to support the project or mitigate blockers.

- Integrate oil and gas and renewable infrastructure to deliver hydrogen solutions.

- Identify risk, uncertainty, and possible mitigation to deliver a timely project.

- Establish a technically feasible and investable concept.

- Enable hydrogen supply and demand.

DownloadsReports

Launch Presentation

Core Group members

- CMC

- Fluor

- National Grid

- Neptune

- Paradigm

- Perenco

- McDermott

- Cadent

The purpose of the Regulatory SIG, led by Energy Transition Advisory (formerly led by Storegga), was to:

- Identify barriers and enablers for the Hub.

- Understand the existing and future regulatory landscape.

- Outline potential Government funding opportunities to support development of the Hub.

Downloads

Reports

Launch Presentation

Core Group members

- Pinsent and Masons

- Spirit Energy

- Altwood

- ENI

- ETA

- Fluor

- Logo

- Mace

- Neptune

The purpose of the Supply Chain and Technology SIG, led by Petrofac and Turner & Townsend, was to:

- Map the existing local, regional, national, and international capability across the hydrogen value chain.

- Assess key supply chain and technology gaps.

- Assimilate best practice and learnings from other clusters to deliver the project at pace.

Downloads

Reports

Launch Presentation

Core Group members

- OPC

- Paradigm

- Xodus