Digital technologies have a strong presence in Operators’ technology plans, with 28 out of the 50 Operators reporting technology targets in this category. This is also a trend that has seen continuous growth since the Technology Insights publication began.

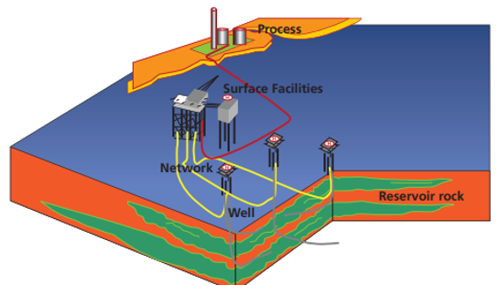

Digital solutions are integral enablers of other technology areas across the life-cycle of oil and gas assets.

Cloud data management and advanced analytics (including machine learning) have been successfully introduced to better exploit existing reserves.

“Connected Worker” technologies enable on-site crews to exchange technical and inspection data in real-time in the field via mobile networks using ATEX rated tablets and head-up displays.

Remote and non-intrusive inspection data are critical for successful asset management strategies such as in predictive maintenance.

Digital & Data technologies

Digital & Data applications are one of the strongest areas of interest according to Operators’ Technology Plans, with over 420 technologies submitted

Parallel to that, there is broad industry participation, with 28 Operators (51% of total respondents) having reported interest in digital technologies

Digital & Data is defined in this document as a ‘cross-cutting’ category, in which digital and data are integral parts of technology solutions in most areas of the offshore asset lifecycle (chart below)

Around 35% of Digital and Data technologies in Operators’ plans are very recent or still under development, suggesting that this is a more established area of UKCS technologies

Whilst the majority of technologies are provided and deployed by vendors and suppliers, in circa 37% of cases Operators take an active role in the development or customisation of the solutions for their assets’ needs

Readiness definitions: Early Development (TRL 1-4), Late Development/Pilot (TRL 5-7), Early commercialisation (TRL 8), Proven (TRL 9)

Operators are increasingly adopting connected worker technologies to enable on-site workers to communicate and receive and record data in the field via mobile networks using ATEX rated tablets and head-up displays. Onshore and offshore control rooms enable remote operations and reduce offshore manning. Digital instrumentation of Christmas trees and flowlines, safety critical maintenance via mobile app, and virtual reality Major Accident Hazard training in the field are also reported. New this year are next generation verification, video sharing, high speed internet connections, asset automations and NUI remote communications.

- High speed internet connection for FPSOs - Serving as a primary connectivity channel for both operational and recreation uses.

- TRL 9 Commercially Available

- Next generation verification: remote access equipment - Offshore audio/video equipment for remote in-service verification

- TRL 9 Commercially Available

- Video sharing during air diving for mooring chain changeout. Video system installed onto the FPSO turret along with a telemetry system to send the video feed to receiving telemetry systems on the DSV and AHT. This allowed real time footage from underwater cameras within the turret to be viewed by all parties.

- TRL 9 Commercially Available

- Onshore/offshore control room linkage (onshore smart rooms) - Where key onshore asset support staff can provide direct and timely support to offshore operations

- TRL 9 Commercially Available

- Onshore/offshore control room linkage (onshore smart rooms) - Where key onshore asset support staff can provide direct and timely support to offshore operations

- TRL 9 Commercially Available

- Use of Independent Wireless Hart network to provide monitoring - including a permanent acoustic leak detection device that can be augmented with temperature monitoring

- TRL 9 Commercially Available

- 4G installation - Creating a network offshore to enable mobile working and more telemetry to be streamed onshore. 4G LTE to follow

- TRL 9 Commercially Available

- TRL 9 Commercially Available

- Virtual Reality MAH Awareness Training - Allows remote training of Major accident hazard awareness for all offshore personnel both new and refreshers. Includes jet fires, pool fires and explosions

- TRL 9 Commercially Available

- TRL 9 Commercially Available

- Mobile app for Ex equipment for Ex equipment maintenance

- TRL 9 Commercially Available

- Asset automations and NUI conversation - Asset simplification and remote control from onshore terminal.

- TRL 1-4 Early Development

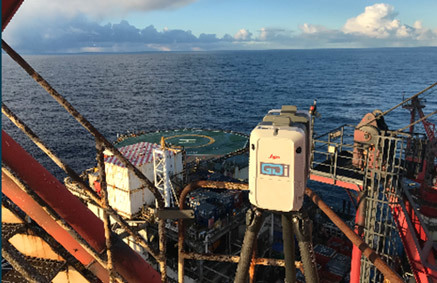

Innovations include improved methods of seismic data acquisition to increase resolution and improve reservoir sweep, laser scanning of assets creating 3D point cloud data with high accuracy, software extracting data directly from documents ensuring revision history is maintained, and flow surveillance using spectral logging technology. Emerging technologies include through tubing cement bond logging (CBL), seabed digital acoustic sensing for carbon storage sites and in-well monitoring in advanced/intelligent wells. New this year are 3D handheld laser scanners, wifi instrumentation mesh, wellhead monitoring, and a big increase in the numbers of Operators using multi-string CBL.

- Metrology - Laser photogrammetry for metrology of subsea spools

- TRL 9 Commercially Available

- Production monitoring models - monitoring of heat exchangers for vibration and performance.

- TRL 9 Commercially Available

- Hand held laser scanner - Allowing the offshore team to complete 3D point cloud scans where and when required to significantly increase the productivity and efficiency of maintenance and modifications projects, especially when linked to a digital twin

- TRL 9 Commercially Available

- Wireless transmitters and creation of wifi instrumentation mesh - For well head monitoring on plugged wells on currently cold stacked and normally unmanned platform.

- TRL 9 Commercially Available

- Spectral noise logging - for reservoir flow surveillance.

- TRL 9 Commercially Available

- Ultra high density ocean bottom seismic (UHDOBN) - The acquisition of densely sampled seismic data to improve reservoir imaging.

- TRL 9 Commercially Available

- Laser scanning - Accurate construction data provided by laser imaging scanner to create 3D point cloud with greater than one mm accuracy

- TRL 9 Commercially Available

- Through tubing CBL and casing wear logging – To verify appropriate annular barriers through multiple tubing / casing strings.

- TRL 5-7 Late Development/Pilot

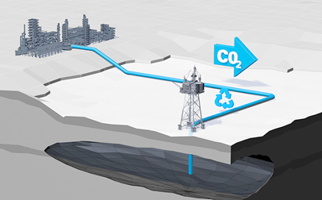

- Seabed digital acoustic sensing (S-DAS) – for carbon storage sites

- TRL 5-7 Late Development/Pilot

- Inventory Optimisation - Automated inventory optimisation and reporting tool.

- TRL 1-4 Early Development

- Automating remote visual inspection – to reduce time to complete visual inspection, increase data quality and reduce human exposure due to lower offshore POB . Fully automated remote visual inspection by utilising point cloud data.

- TRL 1-4 Early Development

Advanced Functionality. Enhanced Visualisation

GDi Vision provides clients with access to a web-based visual platform. This innovative web-based tool enhances operational and engineering functionality whilst delivering material cost benefits to our clients.

- In-well monitoring in advanced/ intelligent wells - Development of tools and techniques for better use of distributed temperature system data with transient temperature and pressure analysis to aid reservoir and well management.

- TRL 1-4 Early development

Operators report digital and database management systems for wells and subsea, software for operations management improvement, online lean check-in applications, and asset integrity management databases. New this year are a single master source of well data for directional surveys, open data, enhanced identification, tagging, tracking & reporting of well information, and high-performance data centre modules utilising excess power. Emerging Technology reported this year includes the Offshore Energy Data Trust to enable industry to share data.

- Wellbore Master Manager and Directional Survey (WMM & DS) on SDU - Aligns well engineering and subsurface data to ensure we are always using the exact same definition of a well/wellbore & directional survey. WMM & DS provides a single master source of well/wellbore and directional survey.

- TRL 9 Commercially Available

- Open data industry project for OSDU - consolidated geoscience data platform within the cloud

- TRL 9 Commercially Available

- Improved data search and classification - Enhanced identified tagging, tracking & reporting of well information at well & field level

- 9 Commercially Available

- Digital - integrated operations - Multiple technology deployments under a digital programme comprising integrated operations centres, IoT, mobility and data and analytics streams to improve efficiency and effectiveness of offshore operations

- TRL 9 Commercially Available

- Asset data management improvement and digitisation - Data Analysis\Mining\Cleanse\Metadata & Classification\Data Presentation & transfer from Documentum to SharePoint.

- TRL 9 Commercially Available

- High performance data centre module – That will utilise excess power from topsides and / or wind turbines

- TRL 9 Commercially Available

- Offshore Energy Data Trust - To enable industry data sharing. Target 10% reduction in risk exposure through utilisation of a data trust

- TRL 5-7 Late Development/Pilot

- Asset integrity management database - Offshore/onshore electronic manipulation of inspection data

- TRL 5-7 Late Development/Pilot

- Check in process - resulting in a reduction in check in time including cascading flight and safety information to passengers. Allows passengers access to their personal details, training competencies, trip history and to receive electronic messaging on flight details

- TRL5-7 Late Development/Pilot

- Flexible integrity assurance - a standard fitness for service methodology for flexible pipes.

- TRL 1-4 Early Development

This sub-category includes advanced timelapse 4D seismic data processing techniques, subsurface modelling to better exploit existing reserves and locate missed pay opportunities, and adoption of AI/machine learning in subsurface modelling. Novel processing methods including relative enhanced elastic impedance, seismic volumes and depth dependant seismic facies inversion, and subsurface modelling for CO2 storage. New this year are depo gridding, subsurface illumination, and an advanced geosteering tool. Emerging technologies include flare efficiency measurement, integration of live process data into emissions monitoring, and integration of UDAR data into reservoir modelling.

- Depo gridding - Trial using unstructured depogrids to model reservoirs,while honouring complex geological structures and layering more accurately than standard geocellular models. Can be used in a next generation simulator.

- TRL 9 Commercially Available

- Subsurface illumination - Enables 3D visualisation of the subsurface while drilling and delivers automated high- resolution models in real time.

- TRL 9 Commercially Available

- Ultra-Deep Geosphere - Advanced geosteering resistivity tool to place wells more accurately in reservoir.

- TRL 9 Commercially Available

- 4D time-lapse seismic data processing - To image oil and water movements within the reservoir. Primary tool used for locating infill drilling targets

- TRL 9 Commercially Available

- Depth-dependent seismic facies inversion - Pre-stack simultaneous facies modelling

- TRL 9 Commercially Available

- Mobile Auto-ID technology such as RFID tags alongside strategies including RBI for Ex inspections and maintenance activities.

- TRL 9 Commercially Available

- Relative Enhanced Elastic Impedance (rEEI) – To generate seismic volumes on reprocessed 3D to aid in hydrocarbon mapping, with relative intensity of response being indicative of pay thickness.

- TRL 8 Early Commercialisation

- Flare efficiency measurement study - Flare gas measurement is often difficult and historically has not been an area of great focus from an operational perspective other than ensuring that the flare is operational due to the critical role it plays in safety.

- TRL 5-7 Late Development/Pilot

- ERAP Implementation – Integration of live process data into emissions monitoring and improvement projects to monitor actual performance vs predicted performance

- TRL 5-7 Late Development/Pilot

- Data integration into reservoir geomodelling - to establish workflows on how to integrate UDAR data information and interpretation in 3D reservoir geomodels, to support better reservoir characterization.

- TRL 5-7 Late Development/Pilot

- AI/machine learning in subsurface modelling - application of learnings from ongoing collaboration with ENRGeo

- TRL 5-7 Late Development/Pilot

- Subsurface CO2 storage assessment - Subsurface modelling with potential for new data acquisition and processing to allow modelling of CO2 injectivity, migration within the reservoir and containment of the CO2 subsurface.

- TRL 1-4 Early Development

Operators report use of software driven solutions for production optimisation, decommissioning scheduling and plan optimisation, production loss analysis, and smart rooms linked to digital twins of offshore assets, real time well engineering, smart monitoring for ESPs, oncoming crew fatigue assessment apps and hydrocarbon accounting / production allocation software. Emerging technology includes drill bit collision assessment software for areas of high well density / positional uncertainty. New this year are a cumulative risk barrier model and an operating envelopes system

- Cumulative risk barrier model - Implementation of industry recognised software solution supporting process safety management. Implement a barrier model solution underpinned by data feeds for work management, well integrity, operational risk assessments and competence systems

- TRL 9 Commercially Available

- Operating Envelopes System - This system monitors safe operating limit excursions

- TRL 9 Commercially Available

- Real time well engineering - Using AI technology to ensure optimal drilling

- TRL 9 Commercially Available

- Improved production optimisation – Use of Integrated Production Modelling software (IPM) composed of of 3 packages to optimise production in the field area.

- TRL 9 Commercially Available

The concept of Integrated Production Modelling (IPM) was pioneered by Petroleum Experts and it involves the elimination of artificial boundary conditions. A change that is made on a pipeline model for example, will automatically change the behaviour of the wells and reservoirs upstream of that pipe, as well as behaviour of all the elements downstream.

- Hydrocarbon accounting and production allocation system.

- TRL 9 Commercially Available

- Smart monitoring for Electrical Submersible Pumps ESP - Condition based monitoring and automatic optimisation of ESPs in wells

- TRL 9 Commercially Available

- Fatigue assessment app - Application for supervisors to assess the fatigue of new crew coming on shift.

- TRL 9 Commercially Available

- Digital oil field system - An integrated production system optimisation model to monitor well and field performance realtime and optimise production output

- TRL 5-7 Late Development/Pilot

- Digital twin & smart room - To enhance efficiency and optimise working practices through a data centric approach

- TRL 5-7 Late Development/Pilot

- Reduce/eliminate risk of drilling collision issues caused by high well density and positional uncertainties plans - Technical and commercial review of At Bit Collision Detection. Failure to mitigate collision risk may reduce field ultimate recovery because some wells targets will be un-drillable or EOR injectors may be positioned sub optimally.

- TRL 5-7 Late Development/Pilot

Operators report use of technologies that enhance the ability to remotely monitor or inspect offshore assets, improve the assessment and tracking of anomalies, and deliver augmented reality from ROVs for subsea wellhead, tubing hanger, tree installation alignment and subsea structure positioning. Also, integrity management software, thermographic camera surveys to detect passing valves and virtual reality platform walks for major accident hazard awareness training. Emerging technologies include AI assisted decision making for well P&A, a plant availability tool, hybrid digital twin technology for FPSO hull fatigue monitoring, metering monitoring software and inspection robots. New this year are UAV data conversion & integration, live 3 D reconstructions for Subsea assets and a caissons database.

- UAV data conversion and integration in - Use of orthomosaic techniques on higher resolution images to enable more structured integrity management. Gives the ability to do time-based reviews by comparing side by side images of the same area.

- TRL 9 Commercially Available

- Live 3D Reconstruction - Live 3D reconstructions allow accurate measurements to be taken of subsea assets such as original jacket member diameters / ovality to enable bespoke clamps to be manufactured.

- TRL 9 Commercially Available

- TRL 9 Commercially Available

- Camera surveys - passing valves - Thermographic setting on cameras used to indicate where valves on flare and vents may be passing. Existing technology but a new use for it.

- TRL 9 Commercially Available

- Integrity Management Software - Integration of water handling, pigging, anomaly management, PLUG reporting, annulus condition, integrity reporting and action tracking, all to support an efficient delivery of PIMS system

- TRL 9 Commercially Available

- Anomaly assessment and tracking - Provides end-to-end traceability and reduces the amount of duplication in the current process.

- TRL 9 Commercially Available

- TRL 9 Commercially Available

- Data management system - Caissons database with improved comparative visualisation of integrity status

- TRL 8 Early commercialisation

- AI assisted decision making for well P&A - Software to aid decision making.

- TRL 5-7 Late Development/Pilot

- Plant availability diagram - Equipment / system availability status tool which shows what's available / operational in real time

- TRL 5-7 Late Development/Pilot

- ROV augmented reality for subsea wellhead, tubing hanger and tree installation alignment

- TRL 5-7 Late Development/Pilot

Fugro Quickvision involves a coded pattern which is stuck onto the subsea asset or foundation. The smart subsea camera operated from an ROV, combined with a range of sensors typically available on an ROV, tracks the coded pattern to measure the position, heading and attitude of the subsea asset in real time.

- Hybrid digital twin technology for FPSO hull fatigue monitoring - Real-time digital hull integrity monitoring using strain gauges installed on the FPSO's hull

- TRL 5-7 Late Development/Pilot

- Data management - better metering information onshore to improve condition monitoring and accuracy of metering data

- TRL 5-7 Late Development/Pilot

- Inspection robot - An autonomous fabric maintenance robotic solution, utilising latest AI, machine vision and machine learning.

- TRL 1-4 Early Development