Digital and Data Category has seen the largest growth of all the categories, The largest expansion of technologies in any sub-category is “Modelling & Analytics” has seen dramatic growth in 2022 data with multiple operator adoptions on multiple assets – Digital & Data Technologies operators are reporting include.

- Advanced Timelapse 4D seismic data processing techniques and subsurface modelling to better exploit existing reserves and locate missed pay opportunities.

“Connected Worker” technologies to enable on-site workers to communicate receive and record data in the field via mobile networks using ATEX rated Tablets and head-up displays.

Software extracting data directly from documents, a digital well book stores data and workflows to determine well potential. Digital and Database Management systems for wells and subsea, software for operations management improvement. Software driven solutions for production optimisation, Decommissioning Scheduling and plan optimisation, smart rooms linked to digital twins of offshore assets. Technologies that enhance the ability to remotely monitor or inspect Offshore assets, augmented reality for ROV’s subsea for wellhead tubing & tree alignment, automated online valve and actuator monitoring , and waste tracking & Management software.

Summary Findings (Click on Sub-Categories for detail)

- Equipment Monitoring & Reliability

Technologies in Equipment Monitoring & Reliability are focussed on remote Condition monitoring technologies, analysis software using AI and ML, and robotic deployment systems to reduce the need for offshore manned inspections with both cost and safety benefits - Integrity Monitoring & Inspections

Integrity Monitoring & Inspections continues to show increasing number of new NII technologies and Robotic Access systems that are being adopted on greater number of assets, operators focus is on technologies using AI & ML to identify Anomalies from live inspection data. - Facility Integrity Repairs

Facility Integrity Repairs sub-category has seen an resurgence in numbers of technologies, Operators report focus on 3D printing for rapid part manufacture, Maintenance access systems, Tablets & Scanning tools for rapid identification of structural fabrication activities, emerging technologies such as laser rust removal, and vibration modelling. - Maintenance & Operations

Maintenance & Operations sub-category continues to show increasing number of new technologies that are being adopted on greater number of assets, operators focus is on technologies that utilise Digital and Data to enhance the connectivity of the offshore worker to the platform environment, virtual assets, digital twins, connectivity between onshore and offshore control rooms and heads up displays are in use or being adopted at scale.

Facilities Management Technologies

- Over 55 technology plans submitted each year from 2018 to 2022

- Showing an Increase in number of individual technologies reported, together with the number of operators reporting interest in this area (Participation of 21 operators in 2022)

- A number (34) of respondents not yet considering this theme (based on submissions)

+ 34 operators not reporting Subsea Systems Techs

- Operators are focusing on a number of technologies ready for deployment (Early Commercialisation TRL 8) and Proven Technologies - existing or in widespread use (TRL 9)

- The pipeline of technologies under development (TRL 1-7) remains healthy

Facilities Management Maturity and Deployments

Once familiar with the technology the same operator deploys it at multiple assets (over 1100 deployments reported/planned for 2021-23)

1. Equipment Monitoring & Reliability

Facilities management technologies in Equipment Monitoring & Reliability are focussed on remote Condition monitoring technologies, analysis software using AI and ML, and robotic deployment systems to reduce the need for offshore manned inspections with both cost and safety benefits

- Streaming Data - Rotating Equipment - Development of PI AF/PI Vision environment to use streaming data for condition monitoring of critical asset rotating equipment

- Apache (Forties) TRL9 Proven Technologies

- Motion Amplification Camera - Motion Amplification to visualize vibrations in standard HD video. Early detection of vibrating equipment. Visualization of actual vibration behaviour. Fast & simple screening of vibration issues

- Shell (Fram, Shearwater, Nelson) TRL9 Proven Technologies

- Optimise Offshore Plant Performance - Offline predictive analytics Machine Learning and AI to Monitor plant performance in association with OPEX and optimise running parameters to reduce GHG emissions

- CNR (Ninian) RSRUK, CNOOC, HarbourTRL9 Proven Technologies

Technology Example :

Asset surveillance & monitoring Pre-configured digital modules – rapid deployment System wide model to identify best practice deviations/anomalies Prioritised threats & actions

View Technology

- OGRIP+ - (Taurob) Tracked robotic system - use of autonomous technology to improve safety and efficiency

- TotalEnergies TRL 8 Early Commercialisation

Technology Example :

The OGRIP project, funded by Total and the Oil and Gas Technology Centre (OGTC). the ATEX Zone 1 certified robots will now be operated for a 12-month period by Total at their Shetland Gas Plant. This will allow us to validate our technology and prove its effectiveness in an operational environment on a long term basis.

View Technology

- Note – There were no Emerging Technologies reported in this sub-category in 2022 data

2. Integrity Monitoring & Inspections

Integrity Monitoring & Inspections continues to show increasing number of new NII technologies and Robotic Access systems that are being adopted on greater number of assets, operators focus is on technologies using AI & ML to identify Anomalies from live inspection data.

- Phased Array Ultrasonic Testing for Pipework - Use of Phased Array Ultrasonic Testing with FlexoFORM probe for topsides pipework inspections

- Harbour (Brittania) Apache (Beryl) TRL9 Proven Technologies

- Drone Inspection - "Caged drone used for internal visual inspection of Slugcatcher and Fingers at St Fergus. The drone video is then used to generate Digital Twin. Drone for fabric maintenance coating inspections of NUI’s “

- Shell (Cutter, Corvette & Leman) TRL9 Proven Technologies

- Shell (Cutter, Corvette & Leman) TRL9 Proven Technologies

- ToolTec caisson inspection - Deployed on ANP to undertake external inspection of the SW caissons to determine wall thickness and assess their condition/integrity. The unit built for caissons >40” diameter. This technology enabled us to avoid deploying people on ropes down towards the splash-zone (high-risk, highly weather-sensitive, and some areas that cannot reach)

- Ithaca (Alba) TRL9 Proven Technologies

- Ithaca (Alba) TRL9 Proven Technologies

Technology Example :

ToolTec have developed a range of cleaning and inspection tools that can be deployed from a platform, capable of cleaning and obtaining inspection data from varying sizes of caissons and conductors.

View Technology

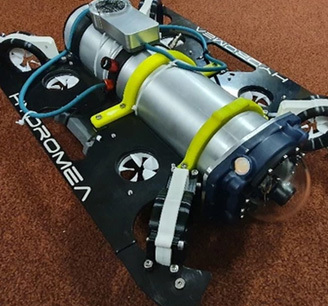

Hydromea ROV ballast tank inspection - Tetherless ROV to allow unmanned tank inspection

- TotalEnergies (Gryphon) TRL 8 Earl Commercialisation

Technology Example :

Hydromea’s focus is to develop a purpose-built system that would be able to take HD scans of the interior of a ballast water tank and take wall thickness measurements. a tether-less semi-autonomous underwater drone uses situational awareness algorithms to navigate a tank and photo-telemetry software to provide 3D heat maps of spots requiring maintenance.

View Technology

- Anomaly Defect Recognition - Analysis of historic and live inspection data to automate detection anomaly defects to improve the accuracy and efficiency of fo integrity management and work execution. GDi

- Harbour Energies (Britannia) TRL 5-7 Late Development/Pilot

- Use of long range UT or alternative method for inspecting corrosion under Pipe Supports Use of long range UT or alternative method for inspecting corrosion under Pipe Supports Repsol Sinopec Resources TRL 5-7 Late Development/Pilot

- Repsol Sinopec Resources TRL 5-7 Late Development/Pilot

3. Facility Integrity Repairs

Facility Integrity Repairs sub-category has seen an resurgence in numbers of technologies, Operators report focus on 3D printing for rapid part manufacture, Maintenance access systems, Tablets & Scanning tools for rapid identification of structural fabrication activities, emerging technologies such as laser rust removal, and vibration modelling.

- 3D Manufacturing - Using advanced manufacturing techniques such as 3D printing to replace parts such as pump impellers and heat exchangers

- TotalEnergies (Culzean) TRL9 Proven Technologies

- Bespoke Clamp & Tool to allow conductor repair - NSP Conductor Repair Project NS16 Conductor

- CNR (Ninian) TRL9 Proven Technologies

- Caisson and conductor integrated cleaning and protective coatings - - Rope access assist platform and large scale application tooling for external cleaning and Stopaq application. Caisson and conductor integrated cleaning and Stopaq application is needed to extend life of these elements. Apply cost-effective and time-efficient it a challenge

- Harbour Energy (Brittania) TRL9 Proven Technologies

- Use of Tablets and scanning tools Offshore for fabrication - Portable hand held scanner

- Repsol Sinopec Resources (Claymore) TRL9 Proven Technologies

- Laser Surface Preparation - Laser Rust removal to time efficiently remove rust for inspection and recoating

- CNR (Ninian) TRL 5-7 Late Development/Pilot

- Kibosh Rapid Pipe Leak Sealing Clamps - Kibosh leak sealing repair clamps. Technology established in domestic/commercial plumbing sector.

- Harbour Energy (Brittania) TRL 5-7 Late Development/Pilot

Technology Example :

The Kibosh Rapid Emergency Pipe Repair Clamp stops leaks immediately, once a Kibosh pipe repair clamp is fitted, the metal or plastic pipe can continue to function normally again under pressure

View Technology

- Flow induced vibration modelling - Initial investigation of potential vibration levels on Knarr FPSO with Rosebank production

- Equinor (Rosebank) TRL 1-4 Early Development

4. Maintenance & Operations

Maintenance & Operations sub-category continues to show increasing number of new technologies that are being adopted on greater number of assets, operators focus is on technologies that utilise Digital and Data to enhance the connectivity of the offshore worker to the platform environment, virtual assets, digital twins, connectivity between onshore and offshore control rooms and heads up displays are in use or being adopted at scale.

- Visual Asset Management - PDMS / Laser PointCloud model / R2S - PDMS / Laser PointCloud model / R2S systems are used to visualise the assets onshore in virtual reality with a view to minimise surveys offshore..

- CNOOC (Buzzard) TRL 9 Proven Technologies

- Onshore Support Control Room - A copy of the Mariner offshore control room onshore

- Harbour Energy (Brittania) TRL 9 Proven Technologies

- Onshore/Offshore Control Room linkage - Set up onshore Operations Rooms where key onshore asset support staff can provide direct and timely support to offshore operations

- CNR (Ninian) TRL 9 Proven Technologies

- Connected Worker - Digital Heat Maps & Operational Risk Identification for Maintenance & Operations Optimisation.

- TotalEnergies (Allwyn) TRL 8 Early Commercialisation

- Hololens smart 'heads up display' glasses - Pilot trial Hololens accelerator program to help visualise plant modifications and projects.-

- Centrica Storage (Rough) TRL 8 Early Commercialisation

Technology Example :

HoloLens to construct and display 3D models, achieving a highly integrated display of virtual information and on-site scenarios for trainings conducted in mixed reality. The use of HoloLens will provide users virtual access to historical data of entire production environments, visual displays of gas reservoirs, wellbores, buried pipeline models, to ensure technicians can fully grasp the specific conditions of the allocated sites.

View Technology

- Caisson & Conductor stabilising system - Polyurethane poured system to stabilise conductors within their guides

- Repsol Sinopec Resources (Claymore) TRL 5-7 Late Development/Pilot