-

Cost reduction estimate is equivalent to £15bn saving

-

Well decommissioning campaign approach gains traction

-

New target will maintain industry focus on cost-efficiency

The cost of decommissioning oil and gas infrastructure has been cut by 25% in the past five years, according to the latest estimates published today.

The North Sea Transition Authority’s (NSTA) Decommissioning Cost Estimate Report 2022 highlights industry’s ability to generate huge savings for the Exchequer and carry out projects in a more cost-effective manner.

The forecast fell £1.5bn (2%) to £44.5bn last year – contributing to a total cut of £15bn (25%) since 2017, when the NSTA introduced a baseline estimate of £59.7bn and set a target of reducing costs by 35% to £39bn by end-2022.

Decommissioning of offshore oil and gas installations is required by law but has long been an expensive and lengthy process. However, the introduction of the target coupled with industry’s ability to learn from experience, share lessons and execute projects more efficiently has been hugely effective.

The highly ambitious 35% target was always intended to be challenging and the significant savings already delivered greatly benefit companies, which can invest more in production and emissions reduction projects, and taxpayers by reducing the cost of decommissioning tax reliefs to the Exchequer.

Industry made swift progress in the first two years of the target, cutting the estimate by 17%, and while that has slowed, partly due to the logistical and economic pressures of the Covid-19 pandemic, progress has continued.

Importantly, the scale of reductions to the estimate is reflected in the final costs of completed projects, which are on average 20-25% lower than initially predicted, over the five years.

In 2021, decommissioning expenditure totalled £1.2bn, lower than the forecast £1.4bn, due to improved project execution and Covid-related deferrals of activity. This was a sizeable investment in the face of unprecedented logistical and economic pressures, and points to industry’s determination to carry out planned work and meet its decommissioning obligations.

Decommissioning spend is expected to ramp up to a peak of more than £2.5bn per year over the next two decades, offering a long-term opportunity for the supply chain to develop cost-efficient services and win more work overseas.

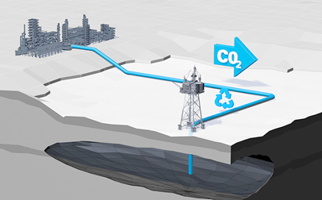

Improving performance on costs is likely to be challenging in the short term due to market inflation and competition for resources from other energy sectors. Therefore, the report calls on industry to redouble its efforts, ensuring that it plans effectively, collaborates on innovative commercial models, deploys new technologies and, where possible, reuses and repurposes infrastructure – all of which are priority areas in the NSTA Decommissioning Strategy. Repurposing infrastructure for energy transition projects, including carbon storage, can also make a significant contribution to the UK’s drive to net zero.

The NSTA is committed to supporting the sector and is encouraged that well decommissioning campaigns, which deliver better value and fewer emissions, have gained traction in the UKCS, as shown by recent, longer-term contract awards.

In addition, the NSTA is harnessing data and digital solutions, such as the NSTA’s Energy Pathfinder portal, Decommissioning Data Visibility pilot project and Suspended Wells application, to provide suppliers with a much clearer picture of upcoming work, giving them confidence to invest in skills and technologies.

Furthermore, as the 2017 target helped to sharpen industry’s focus on costs, the NSTA is providing fresh impetus by engaging with the sector to launch a new baseline estimate and cost efficiency target, effective from the start of 2023.

Pauline Innes, NSTA Head of Decommissioning, said:

“Delivering potential savings of £15bn during a short period marked by extremely turbulent economic conditions should give the sector confidence as it looks to the future.

“The decommissioning market is worth tens of billions of pounds in the UK alone. Our industry is demonstrating that it can complete projects safely, efficiently and economically in the North Sea, and that places it in a strong position to compete for what is a big international prize.

“The sector must not lose focus and allow inflation to drive up prices. Now is the time to build on the progress already made.

“The NSTA is determined to help the sector pick up momentum, including through the introduction of new estimates and targets.”

Notes to editors:

- Read the report here.

- The 2017 baseline figure of £59.7bn was based on 2016 prices.

- A final report on progress against the 35% target, which expires at the end of 2022, will be published mid-2023.

- NSTA Decommissioning Strategy, published May 2021.

- Decommissioning tax relief comes in three forms:

- lower levels of tax on current profits, which are reduced by current decommissioning costs;

- if any decommissioning costs remain, repayments of previously tax paid, when losses resulting from decommissioning expenditure are carried back against past profits; and

- if any decommissioning costs remain after the first two forms of relief, lower levels of tax on future profits, which are reduced by losses created by current decommissioning costs being carried forwards.

In all cases, if decommissioning costs are lower, both the companies and the Exchequer are better off. For further information see here.

For further information please contact:

Tel: 07776 548196