- NSTA opens investigations into missed deadlines for well decommissioning

- £24bn could be spent on decommissioning by 2032

- Operators told to back the UK’s supply chain or risk bottlenecks and price rises

North Sea operators must take action on well decommissioning to support the UK’s supply chain, clean up their oil and gas legacy and stop costs spiralling, the industry regulator has warned.

Repeated delays to well plugging and abandonment (P&A) work, competition for rigs from overseas and cost pressures are pushing up the estimated bill for decommissioning on the UK Continental Shelf.

The facts are laid out in the latest Decommissioning Cost and Performance Update from the North Sea Transition Authority (NSTA), which is getting tough on operators who do not meet their regulatory obligations on well decommissioning.

Pauline Innes, the NSTA’s Supply Chain and Decommissioning Director, wrote to licensees in November 2023 urging them to make headway on the plugging and abandonment of wells and warning that those failing to comply will be held to account.

Members of the NSTA’s Directorate of Regulation have now commenced investigations relating to alleged failures to complete timely plugging and abandonment in line with approved plans.

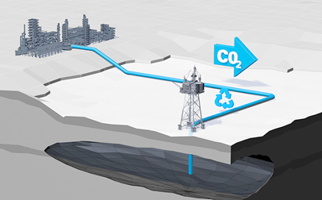

Operators must leave the marine environment clean and safe once they stop producing, and are legally required to decommission their platforms, pipelines and wells, a complex and expensive process which requires thorough preparation and planning.

Taking too long, or deferring work, adds to the cost and can mean that platforms continue to use power and release emissions even though they are no longer producing oil and gas.

Industry’s ability to share knowledge, learn lessons and produce robust plans helped lower the decommissioning cost estimate by £15bn between 2017 and 2022, reducing the cost of tax reliefs to the Exchequer. However, further improvements have been difficult to achieve as much of the low-hanging fruit has been picked.

Operators expect to spend about £24bn on decommissioning between 2023 and 2032, up £3bn on the forecast for the same period in last year’s report. More than half of the overall estimate of £40bn (in constant 2021 prices) is to be spent during this 10-year period, which shows near-term actions will set the direction for the sector. Embedding good practice now and striking a balance between supply chain capacity and demand for its services is crucial.

Pockets of operators continue to collaborate, perform admirably and deliver savings, but the majority need to improve by doubling down on their planning. Operators spent around £2bn on decommissioning last year, which was in line with forecasts, but they completed much less work than originally planned.

They also need to deliver an uptick in well P&A, the most expensive aspect of decommissioning. Operators can keep their costs under control and meet their regulatory obligations by engaging early with the UK’s world-leading supply chain, providing details of their inactive wells and, most importantly, placing contracts to get the work done.

Hundreds of wells will need to be decommissioned every year as more oil and gas fields shut down. However, operators only achieved 70% of planned well decommissioning activities last year.

Some operators are deferring in hope that prices will go down in the coming years. However, failing to award contracts reduces the supply chain’s revenues and ability to invest in capacity and resources. Rig contractors are actively seeking opportunities in other regions where operators offer longer, more secure contracts. If this trend continues, prices will increase, as reflected in market forecasts.

In addition to exploring the use of sanctions, the NSTA is spearheading a project to identify which UKCS wells will be ready for decommissioning between 2026 to 2030 and assess the supply chain capacity required to undertake the work in a timely and cost-effective manner. These insights will guide our efforts to promote and facilitate well decommissioning campaigns involving multiple operators and fields, an approach which can save time and money.

Pauline Innes said: “With spending forecast to peak at £2.5bn per year in the current decade, decommissioning can ensure that the UK’s world-leading supply chain is equipped to help operators clean up their oil and gas infrastructure over the next 50 years and support the carbon storage sector, which will rely on many of the same resources.

“I am concerned that this huge opportunity to safeguard highly-skilled jobs and support the transition will be wasted if operators fail to tackle their well decommissioning backlogs. The supply chain wants to do this work, but it is not physically tied to the UK. Its skills and resources are in demand in other regions, and we are starting to see companies marketing their rigs elsewhere. Operators need to use the supply chain, now, or risk losing it.”

Notes to editors:

Read the report here.

Constant prices adjust for the effects of inflation. The £40bn figure has been adjusted to 2021 prices to give a better reflection of industry’s performance on delivering cost efficiencies.

For further information please contact:

Tel: 07776 548196