April Fools’ Day is nearly here but jokes and pranks will be far from people’s minds.

The energy price cap will be raised that day – bringing with it the grim reality of even higher bills for UK families. Most consumers are already feeling pinched. Motorists have been squeezed at the petrol pump for some time.

Pain is being caused by strong oil and gas demand and an inability of suppliers to keep pace against a backdrop of the Russian government’s invasion of Ukraine, European energy security concerns and the climate emergency.

It all adds emphasis to the drive to rapidly scale up renewables and, while we transition, satisfy as much domestic oil and gas demand with our own resources as possible.

These objectives are not mutually exclusive. They can and must co-exist if we are to achieve an orderly energy transition that delivers broader economic benefits, including jobs and future exchequer revenues, and avoid lurching from crisis to crisis.

Our organisation was founded as the Oil and Gas Authority in 2015, tasked with maximising the value of the oil and gas industry. Last year, we revised our strategy to fully incorporate net zero in our decision making. We are now becoming the North Sea Transition Authority (NSTA) to reflect our expanded role, which includes emissions monitoring and carbon storage licensing.

Oil and gas currently meet around three quarters of our energy requirements and all forecasts show they will be needed for decades. The UK, though, is expected to be a net importer of both out to 2050. We must minimise this reliance on imports, which often have a larger carbon footprint.

Investment in the North Sea is therefore vital, but the increasingly polarised debate shook industry confidence, putting billions of pounds worth of capital expenditure at risk.

The UKCS can still attract investors and is open for the right business. We are stewarding a good number of oil and gas developments in line with our net zero test, ensuring cleaner production, while bolstering energy security and giving the UK options.

We are holding North Sea operators to account on emissions. Our teams are using proactive stewardship, benchmarking and guidance to make sure industry not only meets but surpasses its pledge to halve emissions by 2030, as agreed in the North Sea Transition Deal.

This approach is working. Our interventions stopped more than 1 megatonne of lifetime CO2e being emitted last year, equivalent to taking about 500,000 cars off the road for a year, but this is just a start.

Businesses have made record profits from high oil and gas prices and we want them to honour the Deal now by putting a large chunk towards substantial energy transition projects.

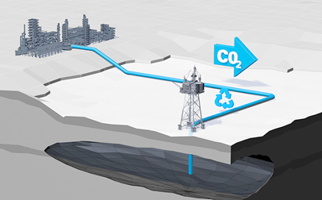

We are supporting investors to press ahead with carbon capture and storage (CCS), platform electrification and hydrogen developments. CCS, in particular, is rapidly coming of age in a basin blessed with world-class stores and infrastructure fit for repurposing. We continue to ramp up our carbon storage licensing activity to support the capture of 20-30 million tonnes of CO2 per year by 2030. While this is encouraging, there is much still to do.

The energy Trilemma of security, affordability and sustainability is not a new phenomenon. However, the amount of attention the constituent parts receive is rarely balanced. COP26 reinforced the urgency of the climate crisis and the importance of sustainability, the recent rise in global energy demand brought affordability to the forefront, and the war in Ukraine has put security of supply in the spotlight. Finding the right pathway to net zero, and showing sound leadership, means always keeping all three in mind. The Deal strikes the right balance. The NSTA will continue to work with government, industry and other regulators to ensure it is upheld and play our full part in the transition.

Dr Andy Samuel, Chief Executive of the North Sea Transition Authority